Our school years can be some of the hardest to manage financially. Odds are you aren’t bringing in as much money as you would be if you were in the workforce full-time, but there are still ways to save money and reduce your spending. It just requires a bit more creativity and resourcefulness. Hopefully, this list of ways to save money as a student, without sacrificing fun, will give you some useful insights to implement in your life.

Our school years can be some of the hardest to manage financially. Odds are you aren’t bringing in as much money as you would be if you were in the workforce full-time, but there are still ways to save money and reduce your spending. It just requires a bit more creativity and resourcefulness. Hopefully, this list of ways to save money as a student, without sacrificing fun, will give you some useful insights to implement in your life.

Always ask for a student discount

I’m sure you’ve heard this one a million times, but it’s true. Most places, even online subscription services offer student discounts. It’s always worth asking for. At the end of the day, why would you pay for something when you can have it at a discount or even free? Some schools even have partner programs that you can claim with your school’s email address – locking you in for 4 years at that price. Amazon, Hulu, Spotify, HBO, and even an IKON Ski Pass are some of the companies I used while in college, off the top of my head. Businesses want everyone’s money, even if it’s a discounted sale. Use this to your advantage! It is by far one of the easiest ways to save money as a student.

Check for discount days

Businesses are always trying new ways to market to students and discount days are one of the most common days. Your favorite spot might have free beer on Wednesdays or half-off cocktails. Some movie theatres also have discounted movie days and times for students. You might be surprised by how many places will cater to students on random days of the week. When I was in college, Wednesdays were big discount days in the area. This meant Wednesday nights we went out and Saturdays we went to the beach. Almost like clockwork. Sure we weren’t going out on a Friday night, but honestly, Wednesday nights made the week fly by that much more. A lot of my friends did this throughout college and it was one of their most effective ways to save money as a student.

Make Your Own Coffee or Matcha

Buying matcha in college was the achilles heel for me. I’d spend $7 per latte around 5 times per week if I was being honest with myself. $35 a week on a beverage I’d consume on the go in about 3.5 minutes. And that’s not even including all the times I’d get coffee with my friends during our morning walks around campus or the beach. I’m sure if I included that, I was at about $60 per week…or $240 a month. WILD! When I realized how out of hand this was getting I went on Amazon, bought a $10 matcha matcha kit and a $15 bag of matcha and started making it at home. This $25 switch saved me SO much money and is a habit I made sure to bring into my post-grad life as well. On the off chance that I wanted to treat myself, I learned that my local coffee shop would sell me matcha at a bulk price if I bought a half gallon – so naturally I’d do that from time to time. I still saved a ton of money.

If coffee is your vice, try getting your grounds from your local grocery store, like a Kroger’s/Ralph’s/Aldi instead of the $20 special bag you’re hooked on. Or if you have a Kreuig-like system, switch to a reusable k-cup and pour in your own grounds. Maybe pull back on the creamers, sugars, and syrups and adjust to a more simple cup of coffee. Whatever it is, there is a way to reduce this recurring cost and still enjoy the thing you love. There is always a way to treat yourself while finding ways to save as a student. It just takes some creativity and reflection.

Travel in larger groups

Traveling during college can seem impossible. My best piece of advice would be to start small. Learn what expenses come up before you plan a cross-country ski trip. Learn who you want to travel with and who never pays people back. You want to learn that when things are cheaper – trust me. Once you’ve figured this out, then get a group together and figure out how much everyone is actually willing to spend and where you want to go. Study that place! When are the cheapest times of the year to travel there? What are the room rates? Buddy up and share rooms. Getting a trip of 6 friends in a 3-bed Airbnb is something you will never regret. So many memories will be made, but then you also get to split every bill 6 ways! Oh and make sure you go grocery shopping on day one of the trip and have a plan for that too! Traveling in college is very possible, you just have to be smart about it and plan!

Sell Your Unwanted Items

We all have things lying around that we don’t want. Whether that is an old skateboard, your old computer, or clothes that no longer fit. Try your best to sell them and get something for it. Facebook Marketplace, Offer Up, and Poshmark, are just some of the resale sites/apps I can think of off the top of my head that are commonly used. Even if you can only get $10 out of it, that’s $10 more than you had before and less clutter in your living space. That sounds like a win-win to me!

Look for a Local Farmer’s Market

Look for a Local Farmer’s Market

Local farmer’s markets saved me in college! It took me a while to find them, but once I did, I made sure to attend them every week. A local farmer’s market can give you access to even more fresh produce produced by local farmers in your area, and odds are, it’ll be tax-free upon purchase. Some of them only accept cash, so make sure you do your homework before you go. Some farmer’s markets even have meats and fish, depending on where you are. Of course, if you live in a place like Kansas, and your local farmers market has 50% off oysters, I wouldn’t take the risk, but your standard fruit and veggies shouldn’t be a problem no matter where you live. Pro tip: make sure you bring a large, or many large reusable bags and maybe a friend to go with you.

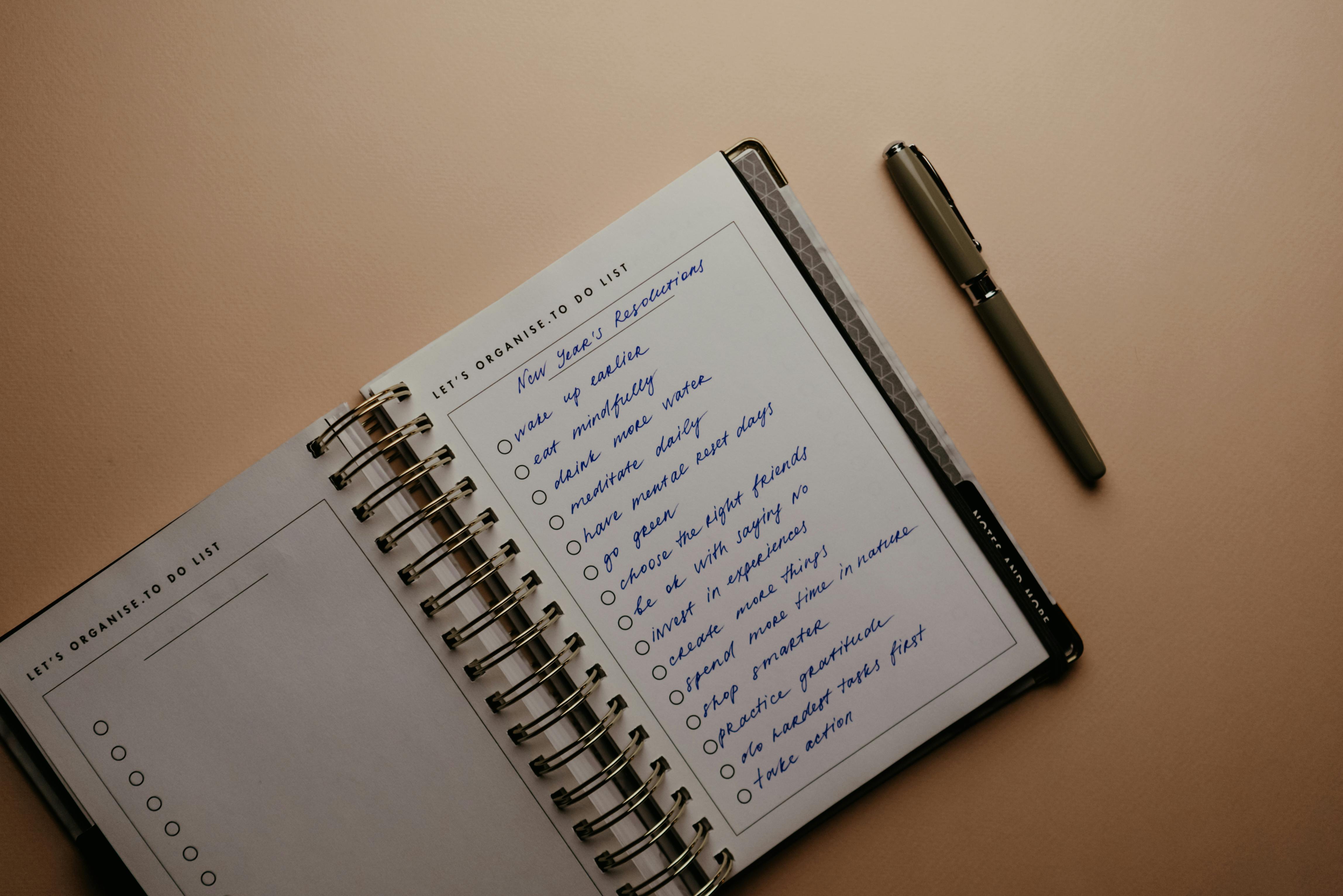

Keep Tabs on Your Impulsive Purchases

It’s so easy to swipe your card or tap to pay throughout the day and not even notice it. I’m a big Amazon person and it’s too easy to add to cart and move on with my day. Although these purchases may be things that you actually need, be careful to not fall into the pattern of buying things just because they come to mind. Think about whether or not you really want that thing and sit on it for a couple of days. Then if you really want or need it, then go ahead and buy it. Otherwise, you might find yourself stuck in buying everything that comes to mind. It’s really easy to make a purchase nowadays. It’s really hard to stop yourself from buying just because.

Skip the Appetizers

I love an appetizer just as much as the next person, but I also realize that it can add another $15 to my bill – and we haven’t even gotten to the drinks yet. Of course, sometimes you just HAVE to have the mouthwatering appetizer, but I’m going to go out on a limb here and say that you don’t need them most of the time. Skipping this part of your meal out with friends will save you a lot of money in the long run. You’re still going out to dinner/lunch/breakfast, you’re just not ordering every part of the menu. Do this 2-3 times and you’ve already made back $50 let’s say. This little change might be one of the easiest ways to save money as a student.

Go Out When It Counts

Going out and being social is just a part of student life – you can’t escape it and you shouldn’t. You’ll probably find your best friend during this period of life, so enjoy it, just be smart about it! Think about what’s a more valuable experience for you. Is it grabbing Chipotle on a Wednesday afternoon because you are too lazy to make lunch, or would you rather use that $10 towards a fun night out with your friends on Saturday? I’m going to guess that Saturday means a lot more to you. It’s really easy to get into the habit of convenience and just pick up a small bite here and there, but when you add it all up, you’re actually spending more than you realize. Get a grip on this and break the bad habit of convenience spending while you’re in school. You can pay for convenience later in your life when time is actually limited.

Rent vs Buy

Textbooks can add up quickly from my experience, and if you don’t have to buy a textbook, odds are you have to pay a couple hundred to access online access key codes to view an online textbook. Although it may be harder to locate, a lot of these online textbook companies will offer a rental or semester-term rental. If you do have to get a hard-copy textbook, Amazon has a whole textbook rental service that will be a fraction of the cost of the book. Always check for this before buying – even if you’re looking to buy a used textbook. The odds are renting will save you a good bit, and then you won’t end up with a collection of books you’ll never use again. Books can be one of your biggest expenses as a student, so it’s always a great idea to focus on this category when thinking of ways to save money as a student.

Refrain from Getting a Pet

Refrain from Getting a Pet

As fun and exciting of an idea as this may sound to be, the financial implication and social inconvenience is something you probably don’t want to have to worry about in your college years. Owning a pet in college means more than just buying food. You’ll have to buy the basic pet care necessities, odds are you’ll buy your pet toys, treats, maybe even clothes. Then what happens when you want to travel and go out of town with your friends? Either you’re going to have to pay extra to have your furry friend with you, or you’ll be paying someone else to watch it. And don’t forget about vet bills. Those are always a surprise. You might even have to worry about an increase in your monthly rent to have a pet. Worry about adding this expense later in your life. If you really want a furry friend, go volunteer at your local animal shelter and have all the fun without any of the daily responsibilities!

There are countless ways to save money as a student. With that in mind, it’s important to remember that it’s not a matter of what you do, that you are doing something at all. You’d be surprised how these small changes can make a huge impact on the finances you have available to you. Let us know what other ways you’ve been saving money.

Look for a Local Farmer’s Market

Look for a Local Farmer’s Market

Refrain from Getting a Pet

Refrain from Getting a Pet